indiana estate tax form

2022 Indiana Estimated Tax Payment Form. 1 2013 this form may need to be completed.

Ohio Quit Claim Deed Form Quites Ohio Marital Status

53329 scholar track students registered online.

. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption allowed for that beneficiary if the property transferred is Indiana real property andor tangible personal property located in Indiana. Print or type your full name Social Security number or ITIN and home address. One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax.

This page contains basic information to help you. It may be used to state that no inheritance tax is due as. Ad Instant Download and Complete your Amendments Forms Start Now.

This application may be filed in person or by mail. No tax has to be paid. What Is an Inheritance Tax and Does Indiana Impose One.

Once the application is in effect no other filing is necessary unless there is a change in the status of the property or applicant that would affect the deduction. However the State of Indiana is not one of them. This form is prescribed under Ind.

2021 Indiana Schedule 2 Deductions. The individual is buying under a contract recorded in the County Recorders office that provides that the individual is to pay the property taxes on the residence and that obligates the seller to convey title to. If you have a simple tax return.

You can also order federal forms and publications by calling 1-800-TAX-FORM 800 829-3676. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. INDIANA PROPERTY TAX BENEFITS State Form 51781 R14 1-20 Prescribed by the Department of Local Government Finance THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER.

Indiana Inheritance and Gift Tax. 2021 Indiana Schedule 1 Add-Backs. Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax.

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. Find forms online at our Indiana tax forms website order by phone at 317-615-2581 leave your order on voice mail available 24 hours a day. As of 2020 12 states plus the District of Columbia impose an estate tax.

All Indiana residents who earned income in the last year must file Form IT-40 with the Indiana Department of Revenue. The amount of tax is determined by the value of those. Indiana Current Year Tax Forms.

Listed below are certain deductions and credits that are available to reduce a. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. Form 8971 along with a copy of every Schedule A is used to report values to the IRS.

Use of Affidavit of No Inheritance Tax Due This form does not need to be completed for those individuals dying after Dec. There is no inheritance tax in Indiana either. Inheritance tax applies to assets after they are passed on to a persons heirs.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. If you need to contact the IRS you can access its website at wwwirsgov to download forms and instructions. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

There is also a tax called the inheritance tax. 2021 Indiana Schedule 3 Exemptions. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account Form IH-19 are required for those dying after Dec.

Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property distributed or to be distributed from the estate if the estate tax return is filed after July 2015. Federal tax forms such as. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

Federal estatetrust income tax. However be sure you remember to file the following. For those individuals dying before Jan.

Auditor Board of Accounts Board of Tax Review Insurance Department of Local Government Finance Revenue Department of Public Retirement System All Tax Finance Services. All Major Categories Covered. Estate tax is one of two ways an estate may be taxed.

Select Popular Legal Forms Packages of Any Category. 2021 Indiana Unified Tax Credit for the Elderly. That is located in Indiana.

Inheritance tax was repealed for individuals dying after Dec. Applications must be filed during the periods specified. Use this form to amend Indiana Individual Forms IT-40 IT-40PNR or IT-40RNR for tax periods beginning before 01012021.

In most states that impose an estate tax the tax is similar to its federal counterpart. Instructions for Completing Form WH-4 This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax. Does Indiana Have an Inheritance Tax or Estate Tax.

There are two kinds of taxes owed by an estate. 26 rows Indiana has a flat state income tax of 323 which is administered by the Indiana Department of RevenueTaxFormFinder provides printable PDF copies of 70 current Indiana income tax forms. When amending for tax periods beginning after 12312020 use Forms IT-40 IT-40PNR or IT-40RNR for that tax period and check the Amended box at the top right corner of the form.

Therefore you must complete federal Form 1041 US. For example most states only tax estates valued over a certain dollar value. Indiana Department of Revenue Consumers Use Tax Return.

Deceased Taxpayers Filing the Estate Income Tax Return Form 1041. APPLICATION FOR PROPERTY TAX EXEMPTION State Form 9284 R10 11-15 Prescribed by Department of Local Government Finance Assessment date January 1 20____ County Name of owner claiming exemption Address number and street city state and ZIP code LAND IMPROVEMENTS BUILDINGS Legal Description Assessed Value Description of Improvements. Find federal tax forms from the Internal Revenue Service online or call 1-800-829-3676.

Applicants must be residents of the State of Indiana. Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. One Schedule A is provided to each.

Enter your Indiana county of residence and county of principal employment as of January.

Real Estate Contract Template New Sample Real Estate Purchase Agreement 9 Examples In Pdf Real Estate Contract Contract Template Purchase Contract

Get Our Image Of Quit Claim For Final Pay Template For Free Quites Mississippi Templates

Pin On Application Form Passport Application Form Application Form Passport Application

Arizona Sports Camp Medical Release Form Download The Free Printable Basic Blank Medical Release Form Template Or Waiver In Word E Sports Camp Medical Arizona

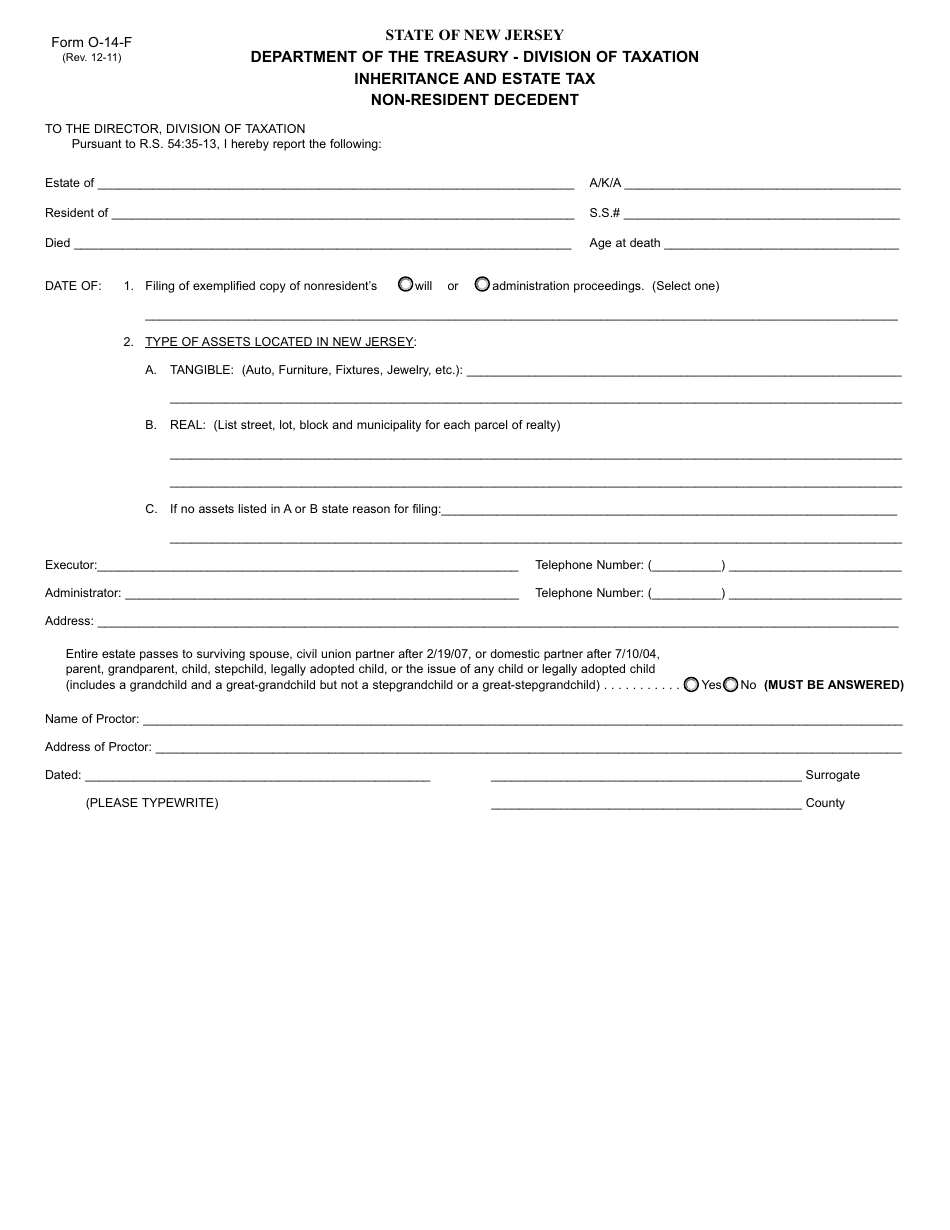

Form O 14 F Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Non Resident Decedent New Jersey Templateroller

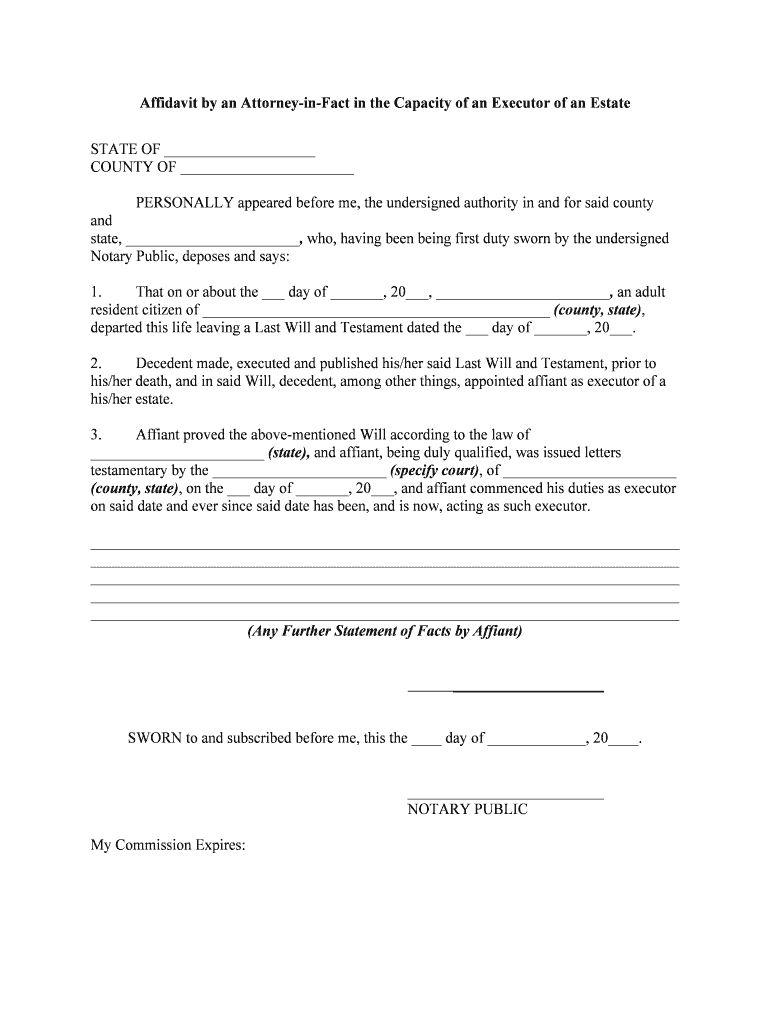

Executor Of Estate Form Pdf Fill Online Printable Fillable Blank Pdffiller

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes